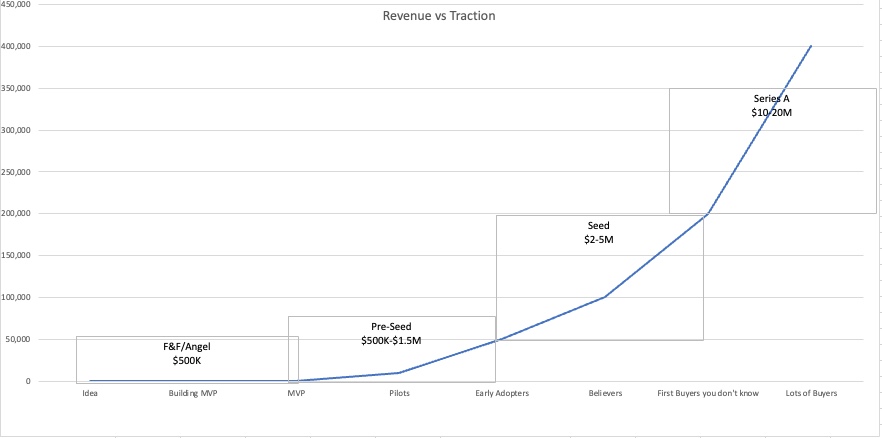

⚡ TLDR: “Pre-Seed” can mean many different things. Here is how Incisive Ventures defines Pre-Seed. MVP in the market for > 3 months, initial customer traction.

Way back in 2004 when I was at Ignition Partners, we led the$4.6M Series A for Docusign, the first institutional money into the pre-revenue company. Oh, how times have changed. As yearly capital deployed to Venture has expanded 10x since then, additional stages have been added. Companies typically raise three or more rounds before a Series A on the back of >$2M in ARR.

At Incisive Ventures, we invest exclusively in the Pre-Seed stage as we define it. We have a specialized set of tools and networks to improve the probability of raising a Seed or Series A based on our constant communication with those follow-on investors in the market.

Another way to look at the stage we invest in is using PaulG’s Startup Curve diagram:

Here are the stages as we see them in the current early 2023 market, along with the risk that is being underwritten in each stage. We see this for B2B and B2C software companies; your mileage may vary.

F&F – Angel

Definition

The first money a company raises typically from friends and family and angel investors. Generally raising around $500K or 12 months of capital, sometimes much more for a second or third-time successful founder. Founders may have an idea, a pitch deck, and a mock-up. Still waiting for product or customer engagement.

Risk Underwritten

- This is all Founder bet. And a bet on the Founder/Market fit.

- Can the founder attract a top-tier team?

- Can the founder raise capital?

- Can the founder build an MVP and get the first customers engaged?

Primary Deliverables/KPIs

- MVP built

- First 5-10 (B2B) or hundreds (B2C) customers engaged with MVP.

- pre-revenue or < $10K a month revenue

- Start a Waitlist (if applicable).

Pre-Seed

Definition

MVP has been built with some understanding from initial customer engagement (Interviews, prior industry experience, key insight into the market, etc.). At Incisive Ventures, we like to see at least 3 months of customer engagement with the MVP and the beginnings of revenue ($5-$10k monthly) before our investment. Generally raising $500-$1.5M for 18-24 months of capital (this has increased from 12-18 months in 2021). Pre-Seed companies will rarely become profitable on this raise, so the primary goal is to get enough traction to raise a follow-on round.

Risk Underwritten

- Finding and measuring Product/Market fit.

- Growth from Post Revenue, (> $5K Monthly) to Recurring revenue of around $50K MRR.

- Hiring more technical and customer/sales team members.

- KPIs to a level the Seed/SeriesA investors will want to invest.

Primary Deliverables/KPIs

- Get to $50K MRR with Pre-Seed money raised ($600K ARR)

- Customer feedback on MVP driving development features to improve Product/Market Fit.

- 10-30% MoM growth in KPIs (revenue, engagement, downloads, etc.)

- Build the waitlist (if applicable).

Seed

Definition

The Seed is about getting enough traction to raise a Series A (the bar for which is higher than ever before). Seed funds typically want to write checks over $1M into rounds of $2-$5M (sometimes more for repeat founders). Seed investors primarily are underwriting scaling product market fit from initial customers to repeatable customer acquisition channels, which can be fueled by Series A investors. Most Seed investors want to see > $500K ARR run rate and a couple viable CAC channels. Valuations today are typically under 30X ARR run rate; the lower the better.

Risk Underwritten

- Scaling MRR from $50K to around $200K.

- Identifying the highest ROAS (Return on Advertising Spend) customer acquisition channels.

- Scaling the sales team.

Primary Deliverables/KPIs

- Driving MRR up to $200K

- Replicable, scalable CAC channels that are ROAS positive.

Series A

Definition

Series A is about pouring gas on the customer acquisition fire and creating growth that will impress the Series B growth investors. Investors want to see a run rate of around $2M ARR growing 2-3x YoY. The goal of Series A is to get to over $10M in annual revenue, where the Series B investors start to get interested.

Risk Underwritten

- Scaling customer acquisition to achieve $10M annual revenue.

- Scaling sales and support team with revenue.

- Scale company infrastructure and team to support growth (CFO, HR, sales, etc.)

- Customer satisfaction can be maintained as sales scale.

- Early customers can become larger customers (land and expand).

Primary Deliverables/KPIs

- $10M annual revenue.

- Customer sat stays high with increased volume.

How can companies stand out as an “outlier”?

Professional investors at each stage see hundreds of companies a quarter. Companies are competing for investor attention without the benefit of understanding the overall start-up environment in terms of comparable company traction, valuation, etc. Investors at every stage want to invest in outliers or potential outliers, so they are looking for some aspect of the company that could predict outlier status.

- Team. Repeat founders with perfect founder/market fit are outliers. It is very hard for a first-time founder to be an obvious outlier.

- Waitlist. Especially if your product has a high price point or LTV. A large, fast-growing waitlist is an outlier. One of my portfolio companies with a $2,500 product had sold hundreds of units but had a 15,000-person waitlist and was able to raise over $25M in a Series A on the strength of their outlier waitlist.

- Revenue Retention. While many companies talk about “land and expand”, very few deliver it. When your revenue per customer goes up Q2Q or YoY, you are definitely an outlier.

- ROAS. The lifeblood of any company is profitable growth. While companies tend to focus early on growth at almost any cost, the sooner you can deliver profitable growth, the better. You are a significant outlier if you deliver positive ROAS (Return on Advertising Spend) customer acquisitions before the Seed.

- KPI growth rate. KPIs vary by stage. In the Angel round, it can be lines of code written, customer interviews, and a waitlist. In Pre-seed, it can be code shipped, app downloads, web traffic, trials, engagement, waitlist, etc. In Seed revenue growth and customer engagement. In Series A, revenue growth, customer retention, return on ad spend, and channel partnerships. Investors who see many companies have an understanding of how KPIs are growing at similar stage/industry companies and will be able to notice outlier KPI growth. At the Pre-Seed, outlier companies typically are growing key KPIs at >20% MoM.

- Strategic Customers. Not all customers are created equal. Strategic customers include potential investors, channel partners, key industry leaders other customers will follow, and customers the press likes to write about. If you are selling B2B, having case studies with name-brand customers is worth 100X more than having no-name customers. Big-name brand customers typically do not work with pre-Series A companies in a meaningful way. If you have one prior to Series A, you are an outlier.

- Customer engagement, churn. Getting customers is expensive. Keeping them is critical. During the pandemic, Peloton had a customer churn of < 0.5%. That was a world-class outlier (and drove the stock). One of my portfolio companies sells a consumer device that has > 80% customer usage after 6 months, which is world-class. Investors will ask about these numbers and compare you. Be prepared.

- Distribution trick. Having a distribution trick to get your product into the market is MUCH more important than having a large TAM. Companies that have identified unique ways to enter the market are outliers. One of my portfolio companies used fundraising from influencers with large audiences as their distribution trick. They had over 1000 influencers as investors with billions of customer reach in their media channels.

- Strategic Investors. Not all investors are created equal. Strategic investors may be future acquirers, or activate their networks to help the company. A great investor syndicate will have a group of investors each with complimentary value-added services like recruiting, business development, fundraising, etc. Great investors pay attention to whom they are investing with. To be an outlier, have an intentionally designed cap table for maximum added value (not just cash).

- Burn Multiple. Defined by David Sacks here. Burn Multiple = Net Burn / Net New ARR. A burn multiple of > 1 is an outlier. This means they are adding more revenue than they are burning cash. If the company has 90% margins, they need a >1.1 burn multiple to generate more cash than they burn.

Great perspective! The outlier list is well articulated.